Features

Asset Management

Why use ERP for asset management?

Using tech to manage and organize your company’s assets can aid you in improving efficiency and maximizing your investments. This is facilitated by managing your assets across all departments, facilities, and locations. Through proper asset management, not only do you maximise your return on assets, but you also reduce costs and risks, and increase asset uptime.

Breaking down the workflow

Let’s take a look at some key asset management concepts before understanding how Spindl implements them in its ERP.

Asset

An asset is a resource owned or controlled by your business. The general expectation from an asset is that it’ll be useful in generating future cash flow. There are various types of assets, however, they all share some key characteristics.

- Ownership: Assets are owned and can eventually be turned into cash and cash equivalents.

- Economic Value: Assets have economic value, and can be sold or exchanged.

- Resource: Assets can be used as resources to generate economic benefits.

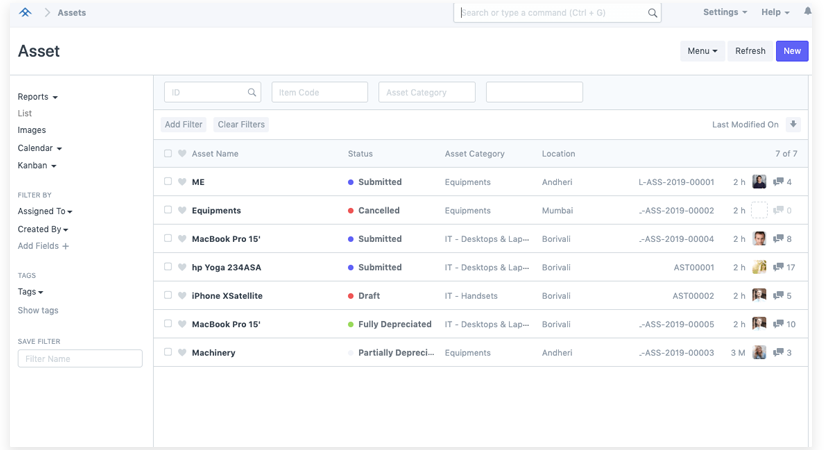

In an ERP, the asset record is at the heart of asset management. All transactions related to an asset (e.g., purchase, depreciation, sales, movement, maintenance, etc.) are maintained and managed against an asset record.

Many factors come into play when managing assets, but to understand them well, we must first take a look at the different types of assets. They’re classified based on three broad factors: convertibility, physical existence, and usage.

Convertibility

If your assets are classified based on their convertibility into cash and cash equivalents, then they’re either classified as current assets (short-term assets) or fixed assets (long-term assets).

Current Assets

If an asset can be easily converted into cash and cash equivalents in a short amount of time (generally a year), then it’s considered a current asset. Stocks, office supplies, short-term deposits, etc. fall under this category.

Fixed Assets

Assets that cannot easily and quickly be converted into cash and cash equivalents are considered non-current assets, or fixed assets. They’re otherwise called long-term or hard assets. Land, machinery, buildings, equipment, patents, trademarks, etc. are all fixed assets.

Physical Existence

If assets are classified on the physicality of their existence, then they’re divided into two categories: tangible and intangible assets.

Tangible Assets

Assets that physically exist (and can be touched, felt, and seen) are considered tangible assets. Machinery, equipment, supplies, computers, buildings, land, etc. are all tangible assets.

Intangible Assets

On the flip side, assets that are not physical in nature are considered intangible assets. They still hold value (based on the characteristics we discussed earlier!) but cannot be touched, felt, or seen. For example, copyrights, patents, trademarks, permits, etc. are intangible assets.

Usage

Lastly, assets that are classified based on their resourcefulness or purpose fall under the category of usage. There are operating assets and non-operating assets.

Operating Assets

Assets that are required for the daily operation of your business to generate revenue are considered operating assets. Examples include machinery, patents, cash, copyrights, building, etc.

Non-Operating Assets

Assets that are used to generate revenue but do not require daily use are called non-operating assets. These include investments, vacant land, interest income, etc.

Asset Transactions

Purchasing an asset

The purchase cycle is generally followed for the purchase of any new assets. Once a new asset is purchased, accounting entries are reflected in the accounting module of your ERP. Details of the asset are entered into the system upon purchase.

Selling an asset

Selling an asset using your ERP follows the sales cycle (starting by creating a sales invoice). This can also be used to enter the gain/loss account so that it can reflect in the company’s records. As is the case with purchasing, accounting entries are made here as well.

Asset Value Adjustment

If the value of an asset changes suddenly due to unforeseen reasons (e.g., damage), the change can be recorded using asset value adjustment.

Asset Management

Categorizing assets

An asset category classifies different assets of your company. You can usually set what kind of categories you want based on your classification method for assets (some of which we’ve discussed above!).

Locating assets

The assets of your organization can be stored at various locations (e.g., admin offices, manufacturing plants, warehouses, etc.). The asset location entry shows the current facility in which an asset is.

Moving assets

When an asset is moved from one location to another, it is recorded using an asset movement entry.

Maintaining assets

Any activity performed on an asset to maintain peak performance conditions is considered to be asset maintenance. Most ERP systems will allow you to categorize maintenance activities while setting up the module (e.g., preventive maintenance, calibration, etc.). Based on the start date and periodicity of the maintenance activities, the system can create to-do tasks for the assigned employee.

Asset Maintenance Team

The employees who are responsible for carrying out maintenance activities on a given asset are a part of the asset maintenance team. These activities can include cleaning, polishing, servicing, or any other activity required to maintain the asset in top condition.

Asset Maintenance Log

For each task in Asset Maintenance, a record is created to keep track of scheduled maintenance activities. This is called the asset maintenance log. It generally has a status (planned, completed, canceled, or overdue), actions performed, and completion date.

Repairing assets

Any activity that is carried out to restore a broken asset to full functionality is called asset repair. Details of the asset’s failure date, error description, repair cost, additional actions, etc. are recorded in this log.

Discarding assets

Asset Depreciation

The timeline of the eventual breakdown of your asset is called asset depreciation. Some ERP systems automatically create a schedule for depreciation based on the depreciation method selected by you.

Scrapping an asset

When an asset is no longer of any use to your business, it is considered scrap.

Asset Reports

Data that is used to generate insight into your assets fall under asset reports. These reports all serve various use cases and are useful in maintaining a keen eye on your company’s assets.

Asset Depreciation Ledger

This report displays the purchase amount, depreciated amount, and accumulated total depreciation for all the assets under the selected date range. It also shows the current value and depreciation status of the asset.

Asset Depreciations and Balances

This report shows the cost of purchase, sale, and scrap of all assets based on your chosen category. It also includes the depreciation details based on the selected period and the net value of the category.

Fixed Asset Register

The fixed asset register provides a unified view of all the details regarding the current status of any given asset that’s present in the system. Consider this to be a consolidated birds-eye report of your fixed assets.

Setting up a workflow

While they don’t need an active workflow for all their assets, Saf and Mel’s employees still create a comprehensive database of Spindl's assets in their ERP system.

- All assets are entered into the system. The current location, category, classification, value, etc. are all stored in the asset master document.

- A maintenance team is created and employees are assigned to various assets.

- Maintenance parameters are set and followed for fixed assets. This also applies to the occasional repairs.

- If an asset is being moved from one location to another, a movement entry is made into the system.

- If an asset breaks down, a repair entry is made into the system.

- At the end of its lifecycle, asset depreciation is calculated and the asset is scrapped.

How Spindl made the most of the ERP Asset module

With all the asset locations and value accessible from one central system and the asset's purchase, maintenance, and lifecycle being tracked accurately, Spindl was able to make more informed decisions regarding these assets.

With the asset maintenance being allocated to responsible people and being tracked regularly, the assets were maintained properly. They became more reliable and the overall breakdown cost was reduced. The uptime of assets increased with their efficiency.

Since all the tangible and non-tangible assets were recorded and tracked properly, Spindl's bookkeeping was flawless and regulatory compliance was met easily.